Crypto.com Overview

Introduction

Founded in 2016 and headquartered in Singapore, Crypto.com has quickly amassed a user base of more than 10 million users and trades in over 100 countries. Crypto.com started with one goal: to accelerate the world into cryptocurrency.

Crypto.com has 3 primary services. The Crypto.com app is its standard brokerage platform and lets users buy and sell cryptocurrency using a debit/credit card. Crypto.com Exchange is its professional exchange offering advanced trading features for experienced traders. The Crypto.com DeFi Wallet is a non-custodial wallet service that allows you to store and transfer your crypto.

This review will discuss the standard Crypto.com brokerage service, which appeals to the broader retail market and briefly summarise Crypto.com Exchange and Crypto.com Wallet.

Is Crypto.com Safe?

The first thing we look at in any exchange is their security. Investing any part of your capital is risky, and using an insecure exchange further increases this risk. Crypto exchanges are a big target for criminal hackers; it’s become the new age bank heist with billions of dollars worth of crypto stolen each year. This begs the question, is Crypto.com secure enough to buy and invest in crypto?

To start, Crypto.com does, unfortunately, have a recent history of being hacked. In January 2022, 483 users’ accounts were breached, and $35 million worth of Bitcoin (BTC) and Ether (ETH) was seized. Luckily, Crypto.com quickly responded, immediately suspending all withdrawals, and all customers had to log in again with two-factor authentications (2FA). Crypto.com reimbursed those affected customers and introduced further measures to hopefully prevent another breach in the future.

As a result of this hack, Crypto.com introduced a new feature that gave users 24hrs to cancel any payment if a new address was added as a payee on an account. Furthermore, it announced Worldwide Account Protection Programme (WAPP), which protects users’ funds up to $250,000 should any theft occur. Users will first have to file a police report and activate multi-factor authentication on their account to qualify for this.

A police report may seem like much, but this closely ties in with another security feature, Crypto.com’s Know Your Customer (KYC) policy, which requires any financial services institution to verify its customers’ identity. This way, no illegal activity can occur, which further secures an exchange.

Additional security measures include:

- 100% offline (cold) wallet storage for the user’s cryptocurrency, with insurance of up to $750 million from any damage or theft

- Users’ fiat currencies are held in regulated bank accounts, with insurance of up to $250,000

- Numerous privacy, compliance, and security certifications and assessments. Regular stress tests and audits on Crypto.com’s core Blockchain systems

- Withdrawal protection and a dedicated team to monitor all deposits and withdrawals

- Anti-phishing code

- Multi-factor authentication, including passwords, biometrics, email, phone, and authenticator (Google). We spent more than an hour trying to login to our account after speaking with one of Crypto.com’s agents because it doesn’t explicitly state ‘Google’ authenticator

Getting Started

Assets & Pairs

Crypto.com currently supports more than 250 cryptocurrencies, including the top 10 cryptocurrencies by market cap, with more being added regularly. You can easily buy these assets on the Crypto.com app and can find a complete list here. Using the Crypto.com Exchange, users also have access to 290+ trading pairs, including 50 BTC pairs and more than 60 USDC pairs. Unless you really want to invest in cryptos no one has ever heard of, it’s more than likely that Crypto.com will have the coins you are looking for.

Sign-up / Verification Process

The Crypto.com sign-up process was very straightforward. As with any institution offering financial services, KYC regulations are in place, so requiring proof of identity for its users is mandatory. After verifying your email address and mobile number, you can upload a government-issued ID document for verification. We used the Crypto.com mobile app to sign up, and after taking a couple of pictures of a driver’s licence, we uploaded it, and verification took less than 10 minutes. We always believe simplicity is key when it comes to those often annoying extra steps, and Crypto.com pulls it off quite well.

We were pleasantly surprised by the new app user incentive, which waived all fees for buying cryptocurrencies for the first 30 days using the Crypto.com app.

Funding Methods

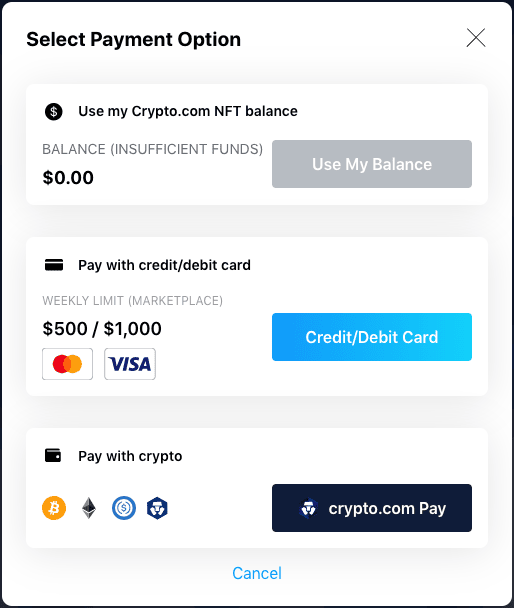

Funding your account will depend on the country you live in. Fiat wallets are available for you to deposit funds from a bank account. Currently, Crypto.com offers support for the following fiat wallets: AUD, CAD, EUR, GBP, USD, USDC, and BRL. Just click on the ‘Transfer’ button on the home screen and click ‘Deposit’. From there, you can either choose a fiat deposit or a crypto deposit. More country-specific info can be found here.

Choosing the crypto option will let you fund your account using crypto from another exchange or wallet. Select the crypto you want to deposit, the network, and copy the crypto address. You can also use PayString, a safer way of sharing your address, using a registered PayString username instead of a full-length wallet address.

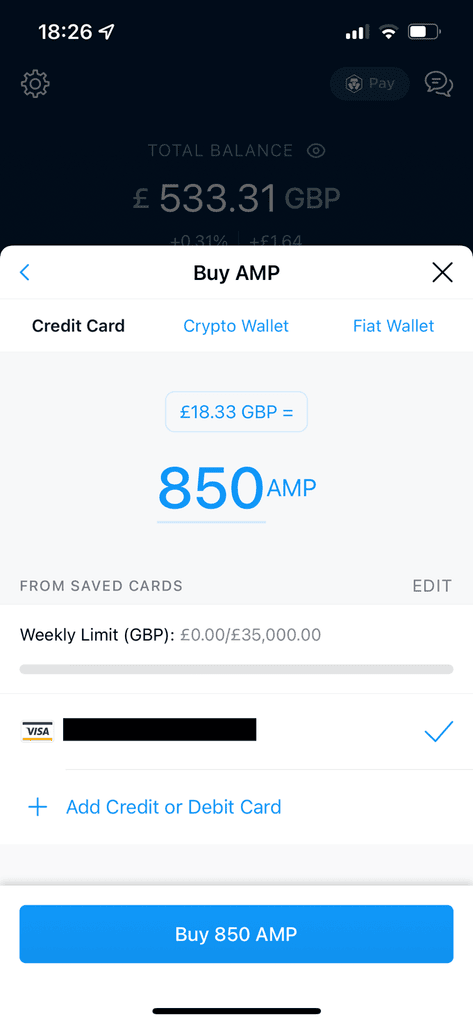

One of the standout funding features is the support Crypto.com provides for Visa or Mastercard credit/debit card purchases of cryptocurrency. It gives a beginner easier access to the crypto world. You can access this by clicking on the ‘Trade’ button from the home screen and clicking on ‘Buy’. Choose your crypto, enter the amount, and you’ll be able to confirm your purchase before it goes through. We highly recommend taking advantage of the new user fee waiver, as Crypto.com charges a 2.99% fee on the total amount on card purchases thereafter.

Withdrawals

Depending on which type of withdrawal you’re trying to do, Crypto.com either makes it simple or a bit of a tedious process. Withdrawing crypto is simple. The easiest way would be to withdraw your crypto to your Crypto.com DeFi Wallet after linking the two together. Like all other exchanges, this does incur a standard blockchain fee depending on which cryptocurrency you’re withdrawing. For example, withdrawing AMP token will incur a 1350 AMP fee (about $35); this is exceptionally high compared to a coin like Bitcoin, which would incur a 0.0001 BTC fee (about $3.7).

We found the process of withdrawing fiat currency very tedious. Crypto.com requires a couple of extra steps compared to an exchange like Coinbase, where you can simply choose an instant cash-out option. First, you need to link your bank account with your fiat wallet by depositing a small amount of fiat currency from your bank account into a Crypto.com bank account. When we signed up, we waited for confirmation for more than 48hrs, which is an eternity in crypto terms. Once confirmed, you need to sell crypto, transfer it to your fiat wallet, then you can withdraw it to your bank account.

Once set up, the process will take between 2 – 4 working days to process the withdrawal; this also includes the 24hr withdrawal lock (a new feature added because of its recent hack).

Overall it isn’t that bad, but some exchanges, notably Coinbase, do this better.

Fees

Crypto.com fees vary depending on what you want to do. You may incur fees for deposits, withdrawals, transfers, and buying crypto. Every exchange’s fees are different, so finding the right one for you depending on your investment purposes is essential.

Fiat crypto purchases

As mentioned before, once you pass the 30-day new user fee waiver, you will be charged 2.99% for the total purchase amount of any crypto when using a debit/credit card. This is quite expensive compared to Coinbase at 2%, or completely free with eToro.

Crypto fees

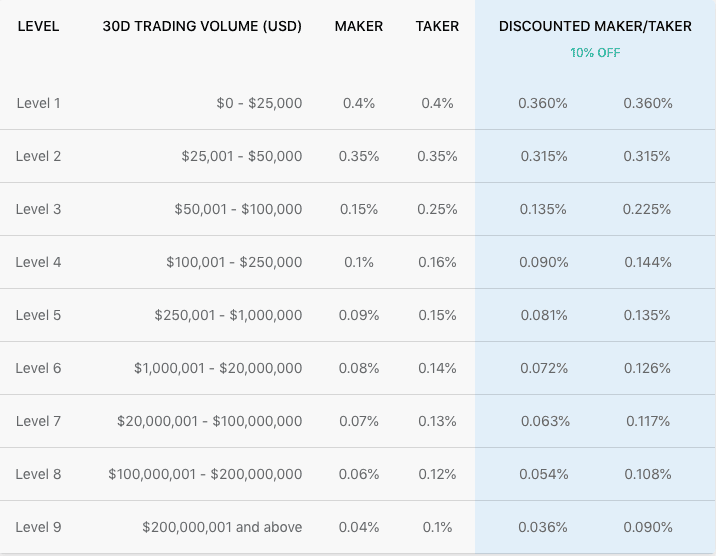

Like most exchanges, Crypto.com uses a maker-taker fee structure on crypto purchases. This means your fee is different depending on whether your order creates liquidity (maker) or your order reduces liquidity (taker). With Crypto.com, however, if you hold and stake CRO tokens in your wallet, you will get a discount on these fees. The more you hold, the better the discount.

Crypto.com’s maker and taker fees, at 0.4%, are quite high. Binance’s fees for the first tier are 0.1%, and Kraken, perhaps a more comparable exchange, starts at 0.26%. This isn’t a big deal if you are primarily looking to buy some crypto here and there, but it does add up over time, especially if you start trading.

The Platform

Platform & Ease of Use

Crypto.com offers two different platforms to buy, sell and trade cryptocurrencies. For the beginner and retail clients, there’s the Crypto.com mobile app which we’ll speak about in the next section.

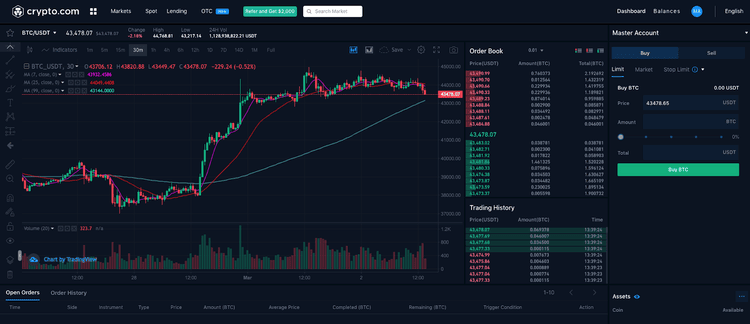

Its more advanced platform, Crypto.com Exchange, was developed with the more adept or institutional trader in mind. We don’t recommend you start here if you’re still finding your feet in the crypto world, as it will probably overwhelm you more than anything. It has a desktop and mobile app, and both offer a professional-looking interface. You can flip through the different tabs at the top of the screen, which will allow you to access the different markets, the trading interface, lending options, and OTC (Over The Counter) trading.

The trading screen is dominated by a large and advanced charting tool with over 70 indicators and an impressive amount of drawing tools. A live order book and market and stop limit features are on the right. You can pull down a menu with all available markets and pairs in the top left corner, indicating the margin possible for each pair.

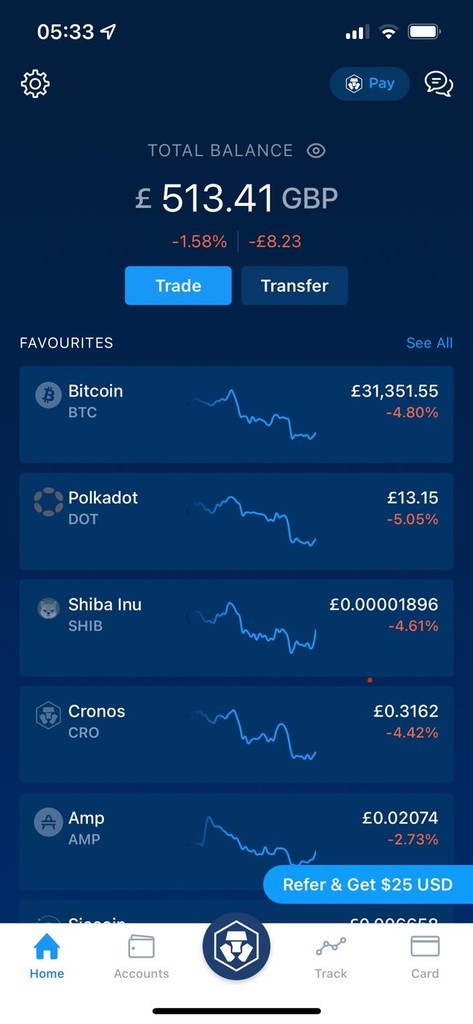

Mobile App

Crypto.com believes that if it can design a mobile app that can provide an excellent user experience, then there’s no need to have it on a desktop too, and they’ve done just that. The mobile app is OK, but we still aren’t too convinced about not having access to the service on desktop. To be clear, the Crypto.com Exchange and Crypto.com app are different products and use different wallets. You can link the two and transfer crypto for free between them, but as a beginner, you wouldn’t want to be using Crypto.com Exchange before getting comfortable with basic spot trading first.

We still think more can be done to develop the app further. It just doesn’t seem as user-friendly and fluid as other crypto exchange apps, such as Coinbase, which was so much easier to do the basics, like buying crypto or withdrawing funds to a bank account. Crypto.com does aim at the mainstream audience, so the ease of use is still good and we can recommend it to beginners. We just think that theCrypto.com is not as smooth and nice as Coinbase’s app.

Trading Features

Crypto.com has features for beginners, advanced, and institutional traders alike. Depending on which Crypto.com platform you’re using, will determine which features are available to you. Crypto.com developed the app to offer brokerage service trading features, with basic spot trading at the core of its development. You can also stake through the Crypto.com Earn via the app and track spending on your Crypto.com visa card if you have one.

There is also a unique feature that we have come across on Binance as well called ‘Crypto Dusting’. This allows you to turn small amounts of cryptocurrency leftover from trades that are under the minimum buy/sell limits and turn them into the native CRO token. It’s like having a piggy bank; those tiny amounts do add up over time!

It’s also maybe not a trading feature per se, but Crypto.com also has a Crypto University where beginners, and even adept traders looking to brush up on their crypto knowledge, can learn all there is to know about the crypto world, from beginner topics like NFTs and more advanced topics like the crypto J-Curve.

For the more advanced trader, Crypto.com has plenty of features. From various markets, limit, and stop loss orders, to perpetual contracts, leverage and up to x10 margin, and futures. It’s safe to say advanced traders can have their fun on Crypto.com as well.

Volume & Liquidity

Volume in cryptocurrency tells us how many buyers and sellers are interested in trading the asset. The higher the volume, the more liquid the asset is, the more competitive the prices. Similarly, looking at the total volume of an exchange can give us an idea of how competitive prices will be when it executes trades.

CoinMarketCap is an excellent tool for measuring the volume and liquidity of an exchange and ranks Crypto.com 12th out of 309 exchanges currently on the market. This is based on a 24hr trading volume of more than $2.2 billion, with a liquidity rating of 659, well above the average of 380. Looking at trading pairs, BTC/USDT has a 24hr volume of over $1.1 billion and a liquidity rating of 675.

With this in mind, we think Crypto.com would be a good investment for your investments.

Additional Features

The Crypto.com Wallet

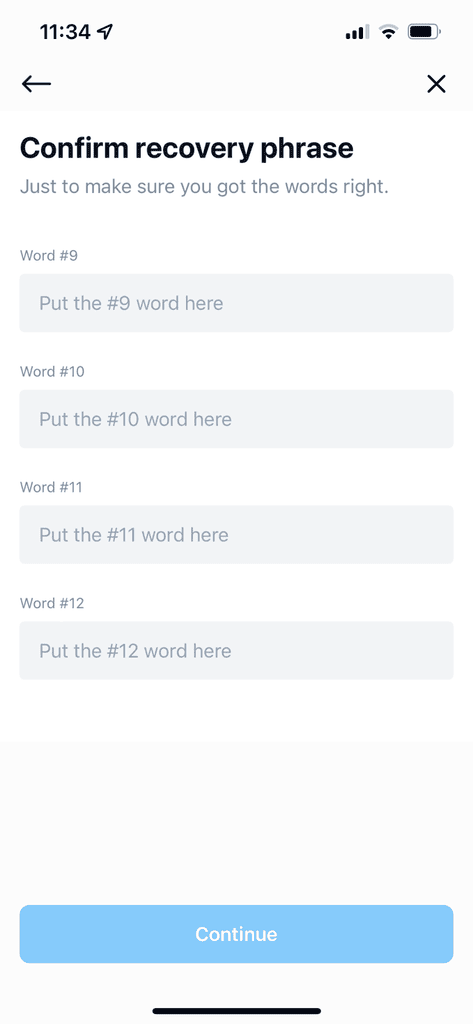

Crypto.com has a non-custodial wallet service called the Crypto.com DeFi Wallet. It is a standalone mobile app available on Apple and Android stores. Non-custodial means that you are in total control of the private keys and funds as the wallet user. This means that you are in charge of the storage of seed phrases and passwords, and if you lose them, you may also lose all of your funds with it, as passwords are not stored on any third-party server.

The Crypto.com DeFi Wallet was straightforward to set up. We downloaded ours from the Apple store on our mobile, and within a couple of minutes, we were set up and ready to go. You will be given a 12-word seed phrase that you need to write down and store somewhere safe, preferably not on your PC or mobile phone, as this defeats the point of having this offline security key.

Linking your Crypto.com wallet to your Crypto.com App is also simple; go to your Crypto.com App settings, look for ‘Crypto.com DeFi Wallet’ under the permission options, and you will be given an option to link the two. Sending funds between the two is straightforward, and you only pay the network fee.

Crypto.com Visa Rewards Card

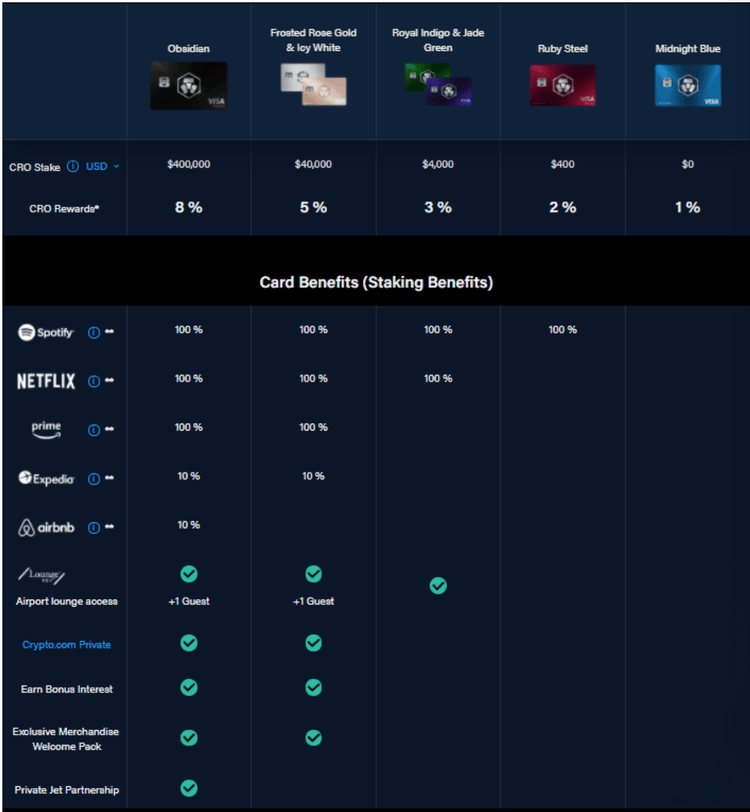

Crypto.com has a visa debit card linked to its native coin, Cronos Coin (CRO). It is a reward debit card that gives its users rewards for holding and staking CRO for a minimum period of 6 months. Starting with a $400 investment, users can earn 2% cashback on every purchase with the card and 100% cashback on your Spotify membership.

The downside is that you get your cashback in CRO, and while it may sound like an appealing offer, there’s still the risk to consider, as the value of CRO could depreciate over the initial 6-month lock-up period instead of gaining value.

Staking

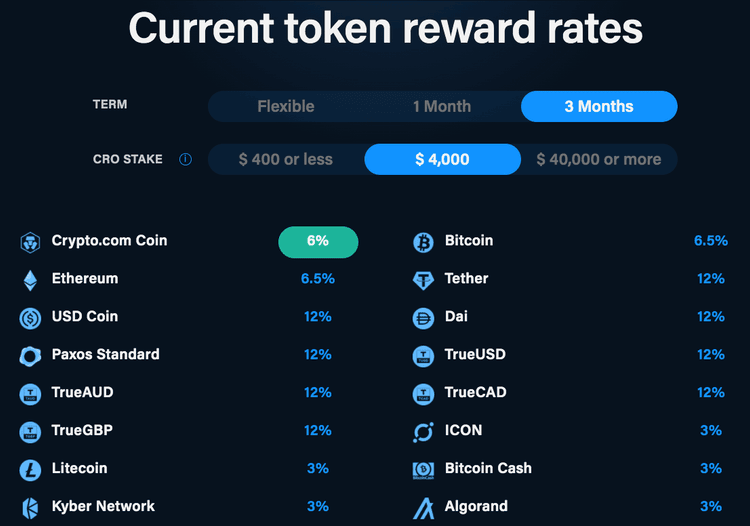

Staking is a way to earn interest on your cryptocurrency by simply keeping it in your wallet for a fixed period, depending on what’s agreed on. Usually, not all crypto is available to stake, and it varies between different exchanges.

Crypto.com calls it ‘Crypto.com Earn‘ and supports more than 40 cryptocurrencies and stablecoins. We think this is a fantastic offering compared to similar exchanges like Coinbase or eToro that offer 4 and 3, respectively. It’s important to note here that before you can stake, you need to have at least $400 worth of Crypto.com’s native token, CRO, in your wallet. Crypto.com wants to grow its coin and, to do that, needs liquidity. This is a perfect way for them to do that, but don’t worry, you still earn high rewards on your CRO and are also given a Crypto.com visa debit card.

We particularly liked that Crypto.com offers staking on a selection of stablecoins. Stablecoins are coins pegged to a fiat currency, such as USD Coin (USDC), pegged to the US Dollar, or TrueGBP (TGBP), pegged to the British Pound. Stablecoins, as its name suggests, is a more stable and less volatile coin to invest in.

So, if you were to stake $1000 worth of USDC for a 3-month minimum term and held $400 CRO for the same period, you would earn a return of 10% p.a in USDC. Interest is paid out weekly, and you can easily reinvest it for a higher reward in totality. You can also choose to be more flexible and not commit to a specific term. However, this comes with lower interest return rates.

Crypto.com has provided a reward calculator that allows you to get an idea of your staking potential before you invest anything, with a list of all available coins for staking.

Lending/Borrowing

Crypto.com has a product called Crypto Credit, which gives Crypto.com App users the chance to monetize their crypto assets without selling them. You can access this via the app, select the cryptocurrency you wish to deposit as collateral, and key in the amount. The loan currency will be in a stablecoin of your choice. There are no late fees or fixed repayment schedules; users just need to pay it back within 12 months; otherwise, Crypto.com will liquidate their collateral.

There are a few exceptions as to who can participate in Crypto Credit. This offering excludes UK, USA, Switzerland, Spain, Singapore, Malta, Hong Kong, Germany, France, Canada, Belgium, and Austria residents.

Customer Support

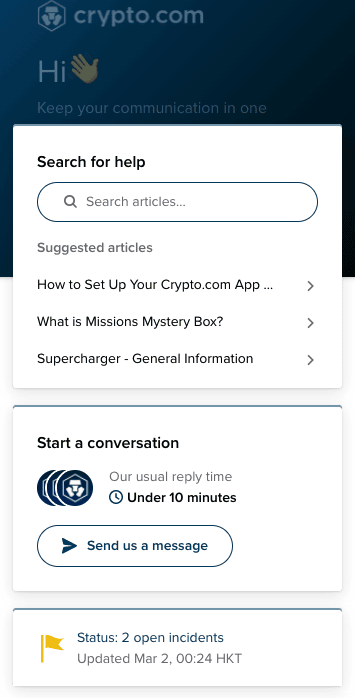

Crypto.com has an excellent help centre with a comprehensive list of articles should you get stuck with anything. We loved the fact that Crypto.com has 24/7 customer support. As mentioned earlier, we came into difficulty logging into our account. We immediately contacted an agent through the little help portal in the bottom left corner of your screen, if using Crypto.com Exchange, or top left using the Crypto.com App. Most other exchanges we’ve reviewed that say they offer human support mainly offer a bot, but we can confirm that we spoke to an actual human being in this case. Crypto.com quickly resolved our issue after verifying our identity and sending a few screenshots of the problem.

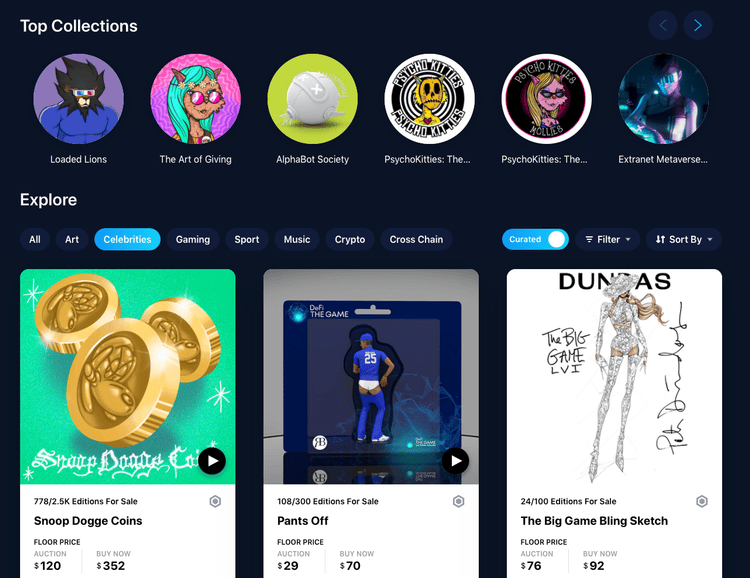

NFTs

Non-fungible tokens are unique and irreplicable assets like in-game assets, videos, and digital art. Crypto.com has recently unveiled its new NFT marketplace and allows users to buy and sell NFTs. You can also mint and sell your own NFTs through the NFT marketplace.

You’ll need to sign up to the marketplace separately. It took us less than a minute to enter our details and have an account verified via email. Using the same email address as your Crypto.com account will allow you to link the two accounts after sign-up is completed. This takes away the added admin of going through the whole KYC process again and links your payment details.

From the Crypto.com NFT marketplace home screen, you can immediately get involved in bidding or buying digital art, with NFTs ranging from as little as $1 to as much as $999.9 million. It features a wide variety of famous artists like Snoop Dogg and Ari Hersch, and even Formula 1 racing team, Aston Martin, has got in on the action and sells numerous NFTs around their new cars and drivers.

Conclusions

Conclusions for Beginners

Crypto.com is an excellent way for beginners to learn all there is to know about cryptocurrency. Beginners can use Crypto.com’s Crypto University before they wish to enter the crypto realm, and 24/7 customer service is there should you need some expert assistance. The Crypto.com app was developed with the idea of accelerating the world into cryptocurrency, so making it simple was their primary aim. New users can also take advantage of the 30-day fee waiver, giving you ample time to learn the platform without spending too much on fees.

If you’re looking for a cheap and secure platform with an extensive array of cryptocurrencies to invest in and some semi-advanced features like staking to dabble in, then the Crypto.com app is for you. We don’t recommend using the Crypto.com Exchange as this is more geared toward the advanced trader.

If you really want an especially soft entry point into crypto, perhaps use Coinbase. Otherwise, Crypto.com will do just fine, and you’ll get access to a much, much better staking offering.

Conclusions for Experienced Traders

For the more experienced trader, Crypto.com Exchange has the most advanced features that should come standard on a professional or semi-professional platform. It is available on both desktop and mobile. Users can participate in basic spot trading, staking, leverage and margin trading, perpetual contracts, futures, and OTC trading. OTC trading offers institutions and traders with significant capital, $50,000 or more, better fees, and rates for large block orders.

Crypto.com staking offers are hard to beat. With its comprehensive selection of cryptocurrencies and stable coins available for staking and excellent reward structure, traders with a bit of knowledge of these currencies will find this highly appealing.